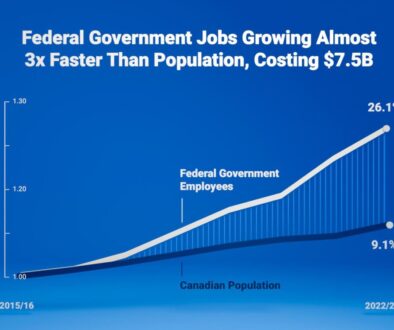

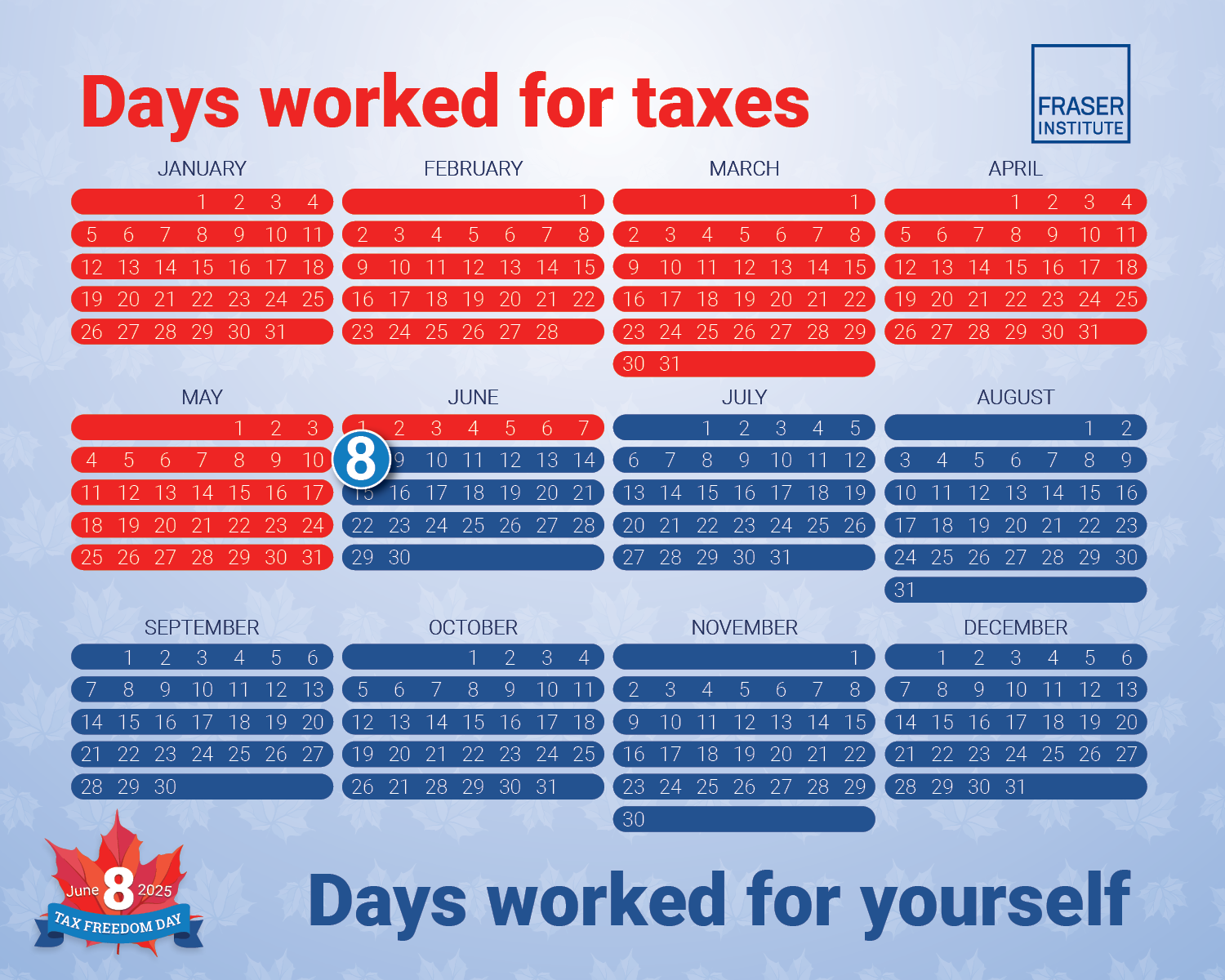

Canadians Celebrate Tax Freedom Day on June 8, 2025

Tax Freedom Day is the day in the year when the average Canadian family has earned enough money to pay the taxes imposed on it by the three levels of Canadian government: federal, provincial, and local. In other words, if Canadians were required to pay all of their taxes up front, they would have to pay each and every dollar they earned to government prior to Tax Freedom Day. Taxes used to compute Tax Freedom Day include income taxes, payroll taxes, health taxes, sales taxes, property taxes, profit taxes, taxes on the consumption of alcohol and tobacco, fuel taxes, motor vehicle license fees, carbon taxes, import duties, natural resource fees, and a host of other levies.

- In 2025, the average Canadian family will earn $158,533 in income and pay an estimated $68,266 in total taxes (43.1%).

- If the average Canadian family had to pay its taxes up front, it would have worked until June 7 to pay the total tax bill imposed on it by all three levels of government (federal, provincial, and local).

- This means that Tax Freedom Day, the day in the year when the average Canadian family has earned enough money to pay the taxes imposed on it, falls on June 8.

- Tax Freedom Day in 2025 comes one day earlier than in 2024, when it fell on June 9. This change is due to the expectation that the total tax revenues forecasted by Canadian governments will increase slower than the incomes of Canadians.

- Tax Freedom Day for each province varies according to the extent of the provincially levied tax burden. The earliest provincial Tax Freedom Day falls on May 17 in Manitoba, while the latest falls on June 21 in Quebec.

- Canadians are right to be thinking about the tax implications of the $89.4 billion in projected federal and provincial government deficits in 2025. For this reason, we calculated a Balanced Budget Tax Freedom Day, the day on which average Canadians would start working for themselves if governments were obliged to cover current expenditures with current taxation. In 2025, the Balanced Budget Tax Freedom Day arrives on June 21.