Banks fraud

- MONEY FROM NOTHING.

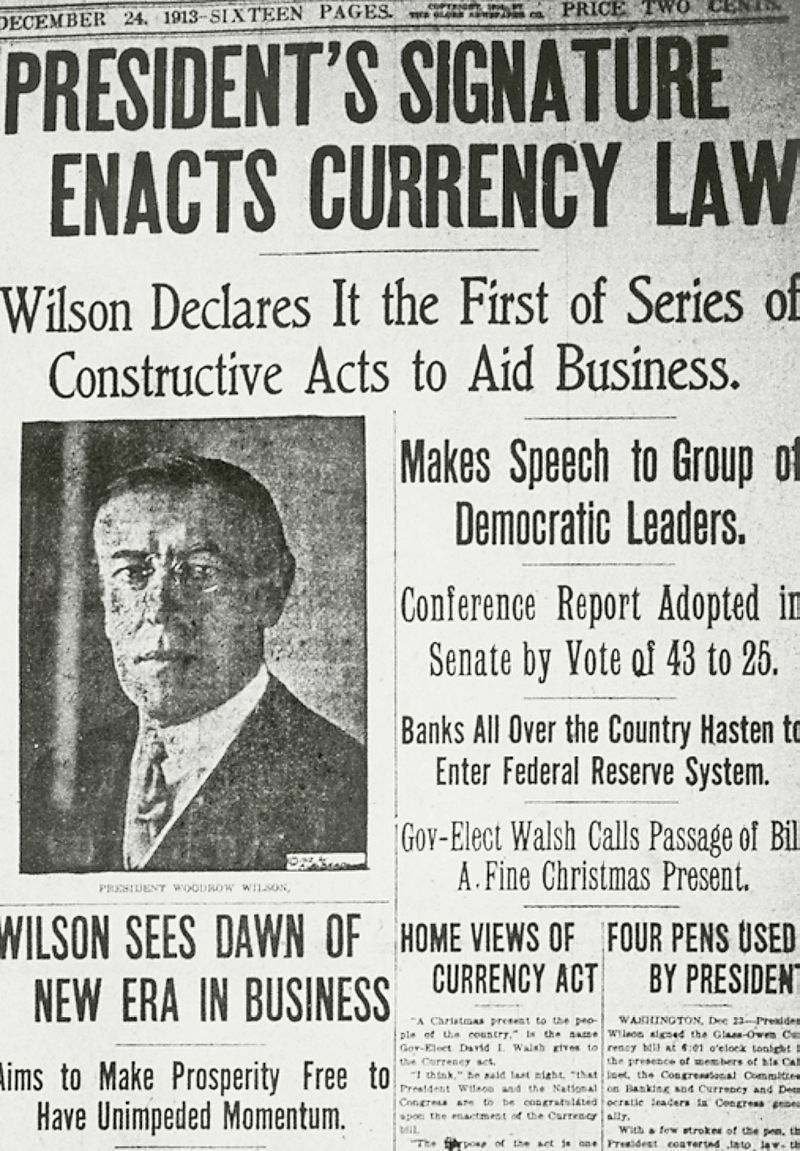

It’s been called the most astounding sleight of hand ever devised. The creation of money privatized, and usurped from Congress by a private banking cartel. Most people think money is issued by fiat through the government, but that is not the case. Except for coins, which compose only about one one-thousandth of the total U.S. money supply, all of our money is created by private banks. Federal Reserve Notes (dollar bills) are issued by the Federal Reserve, a private banking corporation, and lent to the government at interest, creating a huge debt to the nation. A debt the nation can never get out of unless the Federal Reserve Act of 1913 is abolished. Moreover, Federal Reserve Notes and coins together compose less than 3 percent of the money supply. The other 97 percent is created by commercial banks as loans, and backed by nothing.

You don’t believe banks create the money they lend? Neither did the jury in a landmark Minnesota case, until they heard the evidence. First National Bank of Montgomery vs. Daly (1969) was a courtroom drama worthy of a movie script. Every American that is facing a housing crisis should take note.

Defendant Jerome Daly opposed the bank’s foreclosure on his $14,000 home mortgage loan on the ground that there was no consideration for the loan. “Consideration” (“the thing exchanged”) is an essential element of a contract. All contracts need an offer, acceptance and consideration to be valid.

Daly, an attorney representing himself, argued that the bank had put up no real money for his loan. The courtroom proceedings were recorded by Associate Justice Bill Drexler, whose chief role, he said, was to keep order in a highly charged courtroom where the attorneys were threatening a fist fight. Drexler hadn’t given much credence to the theory of the defense, until Mr. Morgan, the bank’s president, took the stand. To everyone’s surprise, Morgan admitted that the bank routinely created money “out of thin air” for its loans, and that this was standard banking practice. “It sounds like fraud to me,” intoned Presiding Justice Martin Mahoney amid nods from the jurors. In his court memorandum, Justice Mahoney stated:

Plaintiff admitted that it, in combination with the Federal Reserve Bank of Minneapolis, did create the entire $14,000.00 in money and credit upon its own books by bookkeeping entry. That this was the consideration used to support the Note dated May 8, 1964 and the Mortgage of the same date. The money and credit first came into existence when they created it. Mr. Morgan admitted that no United States Law or Statute existed which gave him the right to do this. A lawful consideration must exist and be tendered to support the Note.

The court rejected the bank’s claim for foreclosure, and the defendant kept his house. To Daly, the implications were enormous. If bankers were indeed extending credit without consideration – without backing their loans with money they actually had in their vaults and were entitled to lend – a decision declaring their loans void could topple the power base of the world. He wrote in a local news article:

This decision, which is legally sound, has the effect of declaring all private mortgages on real and personal property, and all U.S. and State bonds held by the Federal Reserve, National and State banks to be null and void. This amounts to an emancipation of this Nation from personal, national and state debt purportedly owed to this banking system. Every American owes it to himself . . . to study this decision very carefully . . . for upon it hangs the question of freedom or slavery.

Needless to say, however, the decision failed to change prevailing practice, although it was never overruled. It was heard in a Justice of the Peace Court, an autonomous court system dating back to those frontier days when defendants had trouble traveling to big cities to respond to summonses. In that system (which has now been phased out), judges and courts were pretty much on their own. Justice Mahoney, who was not dependent on campaign financing or hamstrung by precedent, went so far as to threaten to prosecute and expose the bank. He died less than six months after the trial, in a mysterious accident that appeared to involve poisoning. Since that time, a number of defendants have attempted to avoid loan defaults using the defense Daly raised; but they have met with only limited success. As one judge said off the record:

If I let you do that – you and everyone else – it would bring the whole system down. I cannot let you go behind the bar of the bank. We are not going behind that curtain!

From time to time, however, the curtain has been lifted long enough for us to see behind it. A number of reputable authorities have attested to what is going on, including Sir Josiah Stamp, president of the Bank of England and the second richest man in Britain in the 1920s. He declared in an address at the University of Texas in 1927: “The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented. Banking was conceived in inequity and born in sin . . . . Bankers own the earth. Take it away from them but leave them the power to create money, and, with a flick of a pen, they will create enough money to buy it back again. . . . Take this great power away from them and all great fortunes like mine will disappear, for then this would be a better and happier world to live in. . . . But, if you want to continue to be the slaves of bankers and pay the cost of your own slavery, then let bankers continue to create money and control credit.”

Robert H. Hemphill, Credit Manager of the Federal Reserve Bank of Atlanta in the Great Depression, wrote in 1934: “We are completely dependent on the commercial Banks. Someone has to borrow every dollar we have in circulation, cash or credit. If the Banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless position is almost incredible, but there it is. It is the most important subject intelligent persons can investigate and reflect upon.”

Graham Towers, Governor of the Bank of Canada from 1935 to 1955, acknowledged: “Banks create money. That is what they are for. . . . The manufacturing process to make money consists of making an entry in a book. That is all. . . . Each and every time a Bank makes a loan . . . new Bank credit is created — brand new money.”

Robert B. Anderson, Secretary of the Treasury under Eisenhower, said in an interview reported in the August 31, 1959 issue of U.S. News and World Report: “[W]hen a bank makes a loan, it simply adds to the borrower’s deposit account in the bank by the amount of the loan. The money is not taken from anyone else’s deposit; it was not previously paid in to the bank by anyone. It’s new money, created by the bank for the use of the borrower.”

The country’s central bank may determine a minimum amount that banks must hold in reserves, called the “reserve requirement” or “reserve ratio”. Most commercial banks hold more than this minimum amount as excess reserve. Some countries, e.g. the core Anglosphere countries of the United States, the United Kingdom, Canada, Australia, and New Zealand, and the three Scandinavian countries do not impose reserve requirements at all.

They create new money with every loan based on the creditworthiness of the prospective borrower. The loan simultaneously creates an asset and liability. So banks don’t need large amounts of reserves to “lend”. Banks enjoy this privilege as agents of the government which let’s them create Canadian currency. You and I cannot create new money out of thin air line banks can.

- The Following is the Actual Court Record of:

FIRST NATIONAL BANK OF MONTGOMERY VS. JEROME DALY

IN THE JUSTICE COURT

STATE OF MINNESOTA

COUNTY OF SCOTT

TOWNSHIP OF CREDIT RIVER

JUSTICE MARTIN V. MAHONEY

First National Bank of Montgomery,

Plaintiff

vs

Jerome Daly,

Defendant

JUDGMENT AND DECREE

The above entitled action came on before the Court and a Jury of 12 on December 7, 1968 at 10:00 am. Plaintiff appeared by its President Lawrence V. Morgan and was represented by its Counsel, R. Mellby. Defendant appeared on his own behalf.

A Jury of Talesmen were called, impaneled and sworn to try the issues in the Case. Lawrence V. Morgan was the only witness called for Plaintiff and Defendant testified as the only witness in his own behalf.

Plaintiff brought this as a Common Law action for the recovery of the possession of Lot 19 Fairview Beach, Scott County, Minn. Plaintiff claimed title to the Real Property in question by foreclosure of a Note and Mortgage Deed dated May 8, 1964 which Plaintiff claimed was in default at the time foreclosure proceedings were started.

Defendant appeared and answered that the Plaintiff created the money and credit upon its own books by bookkeeping entry as the consideration for the Note and Mortgage of May 8, 1964 and alleged failure of the consideration for the Mortgage Deed and alleged that the Sheriff’s sale passed no title to plaintiff.

The issues tried to the Jury were whether there was a lawful consideration and whether Defendant had waived his rights to complain about the consideration having paid on the Note for almost 3 years.

Mr. Morgan admitted that all of the money or credit which was used as a consideration was created upon their books, that this was standard banking practice exercised by their bank in combination with the Federal Reserve Bank of Minneapolis, another private Bank, further that he knew of no United States Statute or Law that gave the Plaintiff the authority to do this. Plaintiff further claimed that Defendant by using the ledger book created credit and by paying on the Note and Mortgage waived any right to complain about the Consideration and that the Defendant was estopped from doing so.

At 12:15 on December 7, 1968 the Jury returned a unanimous verdict for the Defendant.

Now therefore, by virtue of the authority vested in me pursuant to the Declaration of Independence, the Northwest Ordinance of 1787, the Constitution of United States and the Constitution and the laws of the State of Minnesota not inconsistent therewith ;

IT IS HEREBY ORDERED, ADJUDGED AND DECREED:

1.That the Plaintiff is not entitled to recover the possession of Lot 19, Fairview Beach, Scott County, Minnesota according to the Plat thereof on file in the Register of Deeds office.

2.That because of failure of a lawful consideration the Note and Mortgage dated May 8, 1964 are null and void.

3.That the Sheriff’s sale of the above described premises held on June 26, 1967 is null and void, of no effect.

4.That the Plaintiff has no right title or interest in said premises or lien thereon as is above described.

5.That any provision in the Minnesota Constitution and any Minnesota Statute binding the jurisdiction of this Court is repugnant to the Constitution of the United States and to the Bill of Rights of the Minnesota Constitution and is null and void and that this Court has jurisdiction to render complete Justice in this Cause.

The following memorandum and any supplementary memorandum made and filed by this Court in support of this Judgment is hereby made a part hereof by reference.

BY THE COURT

Dated December 9, 1968

Justice MARTIN V. MAHONEY

Credit River Township

Scott County, Minnesota

MEMORANDUM

The issues in this case were simple. There was no material dispute of the facts for the Jury to resolve.

Plaintiff admitted that it, in combination with the federal Reserve Bank of Minneapolis, which are for all practical purposes, because of their interlocking activity and practices, and both being Banking Institutions Incorporated under the Laws of the United States, are in the Law to be treated as one and the same Bank, did create the entire $14,000.00 in money or credit upon its own books by bookkeeping entry. That this was the Consideration used to support the Note dated May 8, 1964 and the Mortgage of the same date. The money and credit first came into existence when they created it. Mr. Morgan admitted that no United States Law Statute existed which gave him the right to do this. A lawful consideration must exist and be tendered to support the Note. See Ansheuser-Busch Brewing Company v. Emma Mason, 44 Minn. 318, 46 N.W. 558. The Jury found that there was no consideration and I agree. Only God can create something of value out of nothing.

Even if Defendant could be charged with waiver or estoppel as a matter of Law this is no defense to the Plaintiff. The Law leaves wrongdoers where it finds them. See sections 50, 51 and 52 of Am Jur 2nd “Actions” on page 584 – “no action will lie to recover on a claim based upon, or in any manner depending upon, a fraudulent, illegal, or immoral transaction or contract to which Plaintiff was a party.”

Plaintiff’s act of creating credit is not authorized by the Constitution and Laws of the United States, is unconstitutional and void, and is not a lawful consideration in the eyes of the Law to support any thing or upon which any lawful right can be built.

Nothing in the Constitution of the United States limits the jurisdiction of this Court, which is one of original Jurisdiction with right of trial by Jury guaranteed. This is a Common Law action. Minnesota cannot limit or impair the power of this Court to render Complete Justice between the parties. Any provisions in the Constitution and laws of Minnesota which attempt to do so is repugnant to the Constitution of the United States and void. No question as to the Jurisdiction of this Court was raised by either party at the trial. Both parties were given complete liberty to submit any and all facts to the Jury, at least in so far as they saw fit.

No complaint was made by Plaintiff that Plaintiff did not receive a fair trial. From the admissions made by Mr. Morgan the path of duty was direct and clear for the Jury. Their Verdict could not reasonably have been otherwise. Justice was rendered completely and without denial, promptly and without delay, freely and without purchase, conformable to the laws in this Court of December 7, 1968.

BY THE COURT

December 9, 1968

Justice Martin V. Mahoney

Credit River Township

Scott County, Minnesota.

Note: It has never been doubted that a Note given on a Consideration which is prohibited by law is void. It has been determined, independent of Acts of Congress, that sailing under the license of an enemy is illegal. The emission of Bills of Credit upon the books of these private Corporations for the purpose of private gain is not warranted by the Constitution of the United States and is unlawful. See Craig v. Mo. 4 Peters Reports 912. This Court can tread only that path which is marked out by duty. M.V.M.

JEROME DALY had his own information to reveal about this case, which establishes that between his own revealed information and the fact that Justice Martin V. Mahoney was murdered 6 months after he entered the Credit River Decision on the books of the Court, why the case was never legally overturned, nor can it be.

III. JEROME DALY’S OWN ENTRY

REGARDING JUSTICE MAHONEY’S MEMORANDUM

FORWARD: The above Judgment was entered by the Court on December 9, 1968. The issue there was simple – Nothing in the law gave the Banks the right to create money on their books. The Bank filed a Notice of Appeal within 10 days. The Appeals statutes must be strictly followed, otherwise the District Court does not acquire Jurisdiction upon Appeal. To effect the Appeal the Bank had to deposit $2.00 with the Clerk within 10 days for payment to the Justice when he made his return to the District Court. The Bank deposited two $1.00 Federal Reserve Notes. The Justice refused the Notes and refused to allow the Appeal upon the grounds that the Notes were unlawful and void for any purpose. The Decision is addressed to the legality of these Notes and the Federal Reserve System. The Cases of Edwards v. Kearnzey and Craig vs Missouri set out in the decision should be studied very carefully as they bear on the inviolability of Contracts. This is the Crux of the whole issue. Jerome Daly.

SPECIAL NOTATION. Justice Mahoney denied the use of Federal Reserve Notes, since they represent debt instruments, not true money, from being used to pay for the appeal process itself. In order to get this overturned, since the bank’s appeal without the payment being recognized was out of time, it would have required that the Bank of Montgomery, Minnesota bring a Title 42, Section 1983 action against the judicial act of Justice Mahoney for a violation of the Constitution of the United States under color of law or authority, and if successful, have the case remanded back to him to either retry the case or allow the appeal to go through. But the corrupt individuals behind the bank(s) were unable to ever elicit such a decision from any federal court due to the fact that because of their vile hatred for him and what he had done to them and their little Queen’s Scheme, had him murdered (same as them murdering him) just about 6 months later. And so, the case stands, just as it was. Amazingly, if they hadn’t been so arrogant about the value of their federal reserve notes and paid the Justice just 2 measly silver dollars, or else 4 measly half dollars, or else 8 measly quarters, or else 20 measly dimes, or else 40 measly nickels, or else 200 measly pennies, they could have had their appeal and would not have had to get blood on their hands.

As it is, they are now known for their bloody ways, and the day will come when the American people will reap vengeance upon them for such a heinous and villainous act. Amen.

Sofia

December 1, 2024 @ 5:46 pm

Comment:

This is a fascinating and eye-opening article about the concept of banks creating

money out of thin air through the process of fractional reserve banking.

The case of First National Bank of Montgomery vs.

Daly is a prime example of how the legal system grapples with this issue.

It appears that the jury in this case found that the bank

did not have a lawful consideration for the loan because the money was created out of

thin air rather than being based on pre-existing funds. This raises important questions about the nature of money and the role

of banks in the economy. It would be interesting to see more discussion on this topic and whether there are any efforts

to change the current system.

On a separate note, I would like to commend the author for presenting this information in an accessible and engaging manner.

It is clear that a lot of research and thought went

into this article. Thank you for sharing this important information with the public.

Sincerely, Daniele

u-asta

December 2, 2024 @ 7:19 am

VW