Local governments sitting on piles of cash

Note: Financial Assets include cash, cash equivalents, accounts receivable and short-term investments.

What happens when a municipality decides to replace important infrastructure? Presumably, it has much of the needed funds sitting in reserves.

But residents of Osoyoos, population around 5,500, are facing property tax increases of almost 40 percent, even though the small community has an accumulated surplus of almost $100 million. According to CBC reporting, the council says the increase is needed to replace and upgrade water and sewer infrastructure.

I suspect the proposed increase is part of a commonly used strategy. When threatened with a huge jump in property taxes, people are likely to accept increases of lesser amounts, even if those are far beyond the rate of inflation.

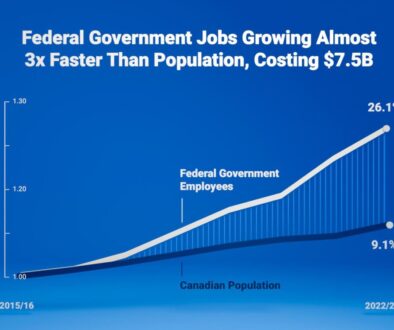

There are signs that some municipalities want to accumulate cash beyond reasonable requirements. Burnaby for example had more than $2 billion in cash and short-term investments at the end of 2022, according to the last financial report available to the public.

One significant problem is that when municipal budgets and tax levels are discussed in public, information available to citizens is outdated. If the people of Osoyoos question an outrageous tax increase in 2024, the most recent financial statements they can read are for 2022.

Most public organizations issue quarterly reports. Most BC municipalities do not. But we can be certain that senior bureaucrats are reading financial statement for each and every month within days of period end. They just choose not to share that information with the public.

Recently, I sent a message to the BC Ministry of Municipal Affairs. I wrote this:

Most public organizations of significant size issue quarterly reports. Is there a reason the BC Government does not require municipalities to issue quarterly reports? Internal accounting is available to issue digital copies of these with little or no public expense.

More frequent reports would help the public understand the financial state of local governments. As it is now, citizens do not have current information when councils establish current-year property tax rates.

Here is one example offered to me of a situation that would be unlikely to occur if municipal finances were more transparent:

“A municipality created a multi-million dollar reserve for emergencies. When someone suggested opening a shelter or warming centre for homeless people during severe weather, local officials said there was no money available. When asked why funds from the emergency reserve could not be used, they responded that the funds were already committed. When asked to what they were committed, the response was the emergency reserve.“

The Ministry of Municipal Affairs did not respond to my inquiry. Perhaps the BC NDP government does not believe in freedom of information. They seem to prefer that we remain free from information.

Originally published: www.in-sighst.ca/2024/01/19/local-governments-sitting-on-piles-of-cash/

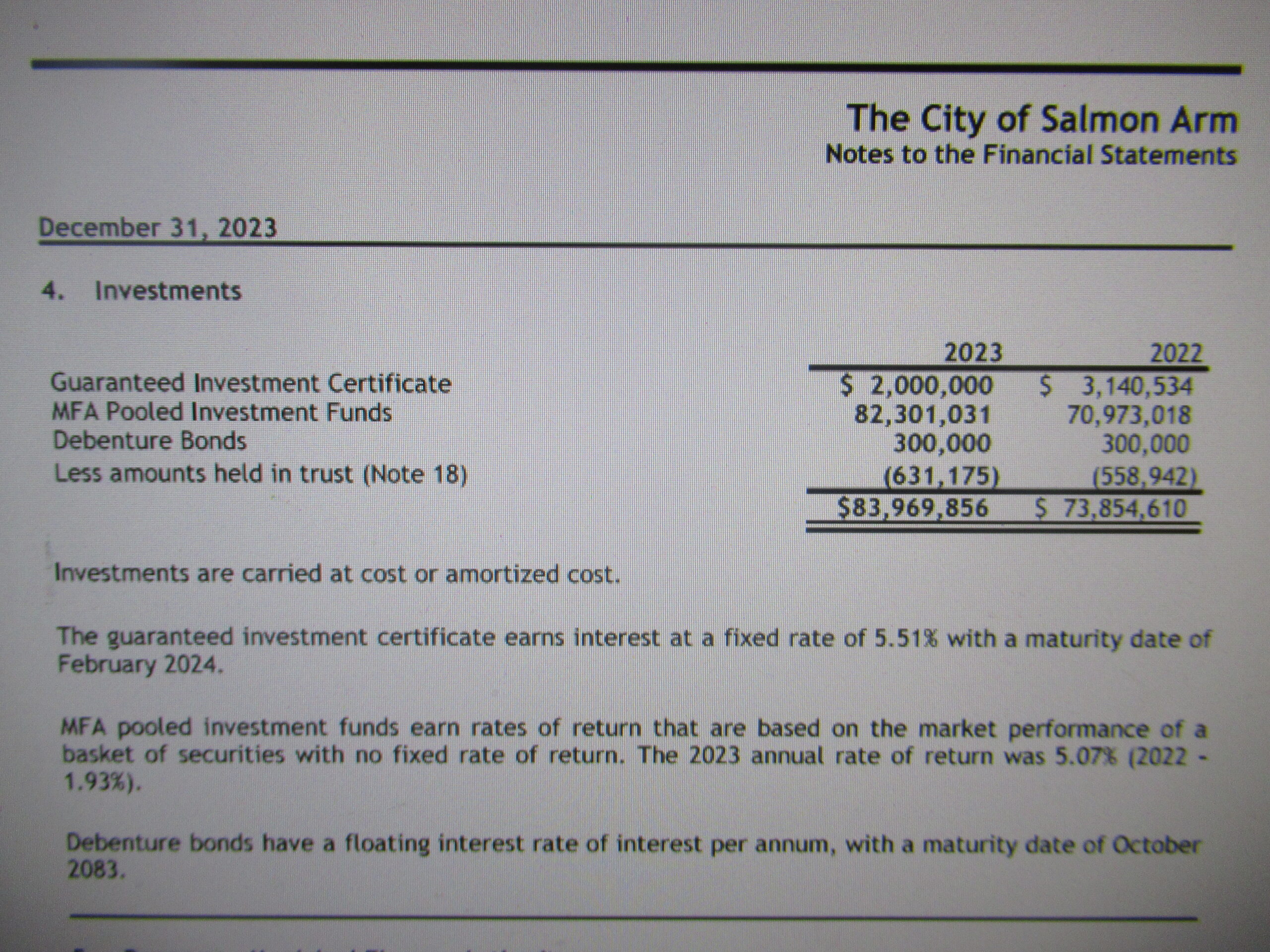

As per day December 31, 2023 City of Salmon Arm had following investments:

https://salmonarm.ca/ArchiveCenter/ViewFile/Item/1217 – page 79